Hi.

Welcome to my portfolio. I document my work in product design and user experience here. Hope you have a nice stay!

Welcome to my portfolio. I document my work in product design and user experience here. Hope you have a nice stay!

This project summarizes three iterations of the same experiment theme, customization, resulting in 13.8% conversion improvement for the Student Loan Refinancing product at SoFi. The insights driving this experiment were from existing qualitative and quantitative research and drop-off data. We had recently released a new version of our flow, eliminating tech debt and allowing us to begin experimenting and creating custom flows and experiences for different cohorts.

My role

I led Product Design for SoFi Student Loan Refinancing for over a year. I collaborated with a Product Manager, Researcher, Content Strategist, Core Team Designer, Data Scientist and Engineering team.

Timeline

Total time spent was under one week per iteration. The three iterations spanned three quarters.

Background

The first page of our application flow was one of our biggest drop-off areas (~9% vs. <1% on other pages). It started with date of birth and citizenship status which we felt was stale and transactional. The funnel was “one size fits all” without any personalization.

Iteration 1: Goals and Recommendation

Strategy

My product partner and I brainstormed strategies and decided to focus on motivation and priming. We would add an initial question to uncover their motivation before collecting information (date of birth, address, income, etc.) and message this goal back by recommending a product offer with copy that aligned to that goal. This approach would be a lightweight build and gain us insights to iterate with later.

Hypothesis

We believe that our users have different goals that cause them to select different product offers. We know that providing a recommended product offer increases conversion. If we provide a customized recommendation and priming the user to the recommendation early in the funnel we will increase conversion.

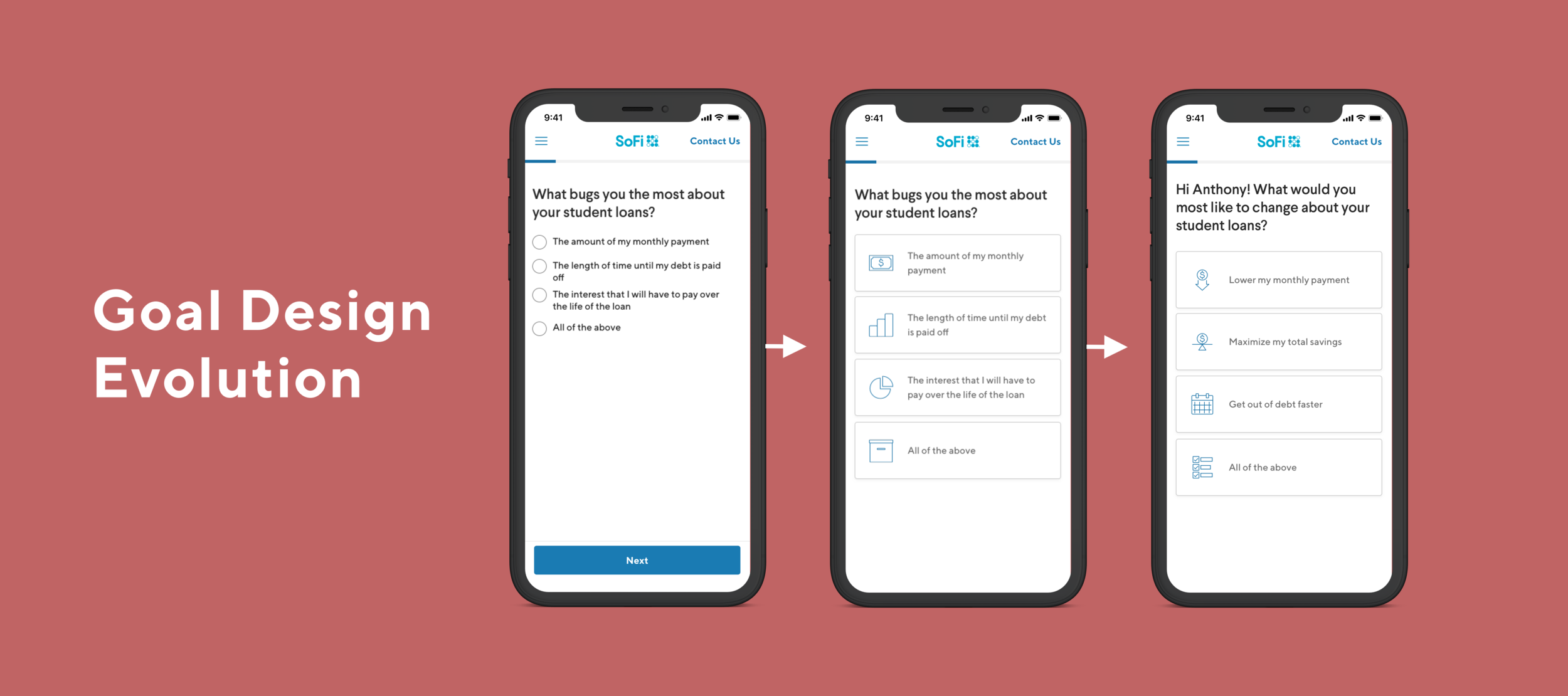

Research and Ideation

To create the goal options, I referenced existing research including global SoFi segments, Student Loan Refinancing Personas, and Student Loan Refinance customer segments to inform the options offered. I worked with our Content Strategist to refine these options. I also worked with the Design Systems team to create new icons to represent these options.

Identifying our customers: segments, value prop appeal

Variants

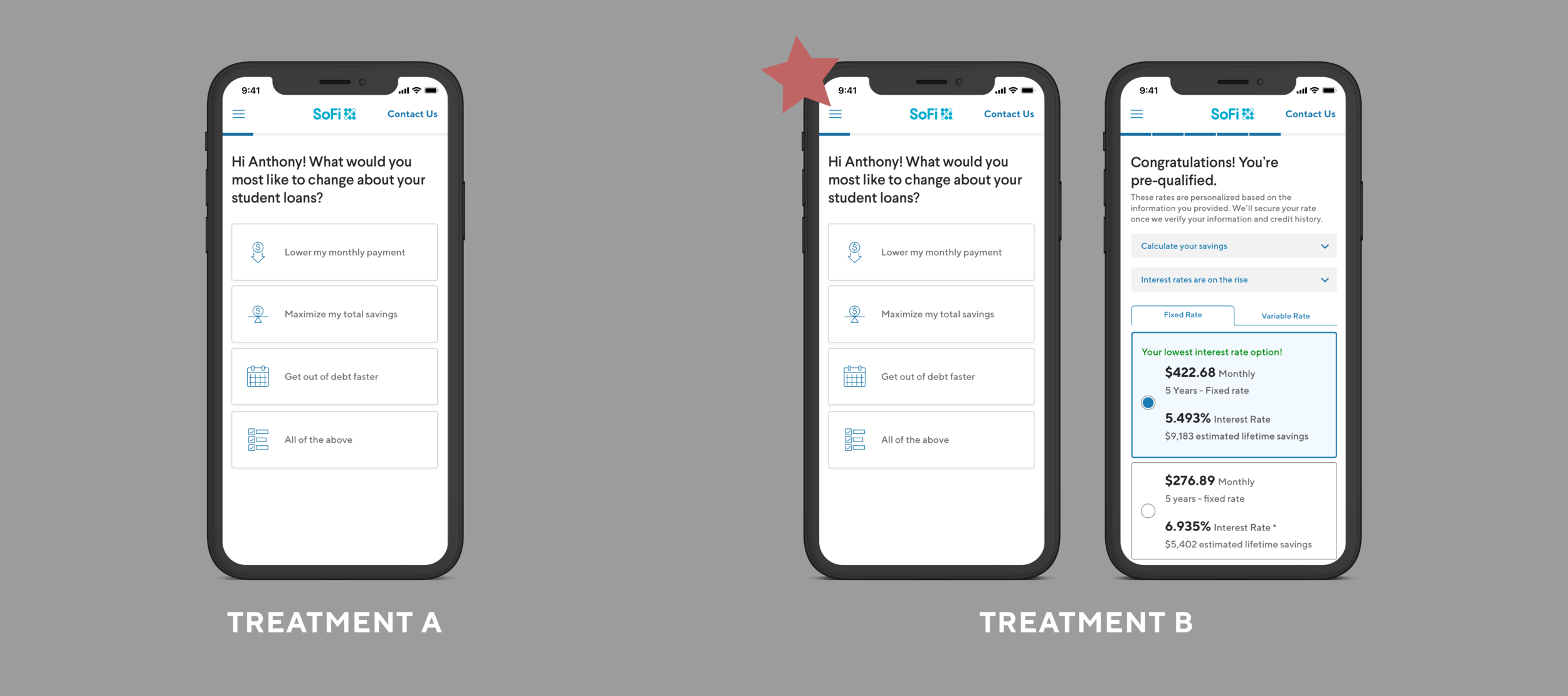

Because we wanted to test two changes, we had two variants to ensure we could pinpoint the change driving results.

Control - No change

Treatment A - Goal Questions Only

Treatment B - Goal Questions + Pre-selected offer with tailored recommendation

Results

Treatment B achieved relative conversion lift of 5%.

Insights

To learn more about our user’s decision, I reviewed the goal selections and product selection behavior with my Data Science partner. We had to ensure this experiment was not driving changes in product selection that could hurt revenue and investor appetite. We found that this was not having an effect on those metrics and ramped Treatment B to 100%.

Strategy

To learn more about our user’s motivations, we agreed to try other goal variants.

Research

I leveraged a survey that my researcher had just closed on for another project that asked “What is your TOP goal for refinancing your student loans.” The results gave me insight into other goals.

Methodology

National survey targeting 500 in-market SLR shoppers

Target Audience

- Plan to apply to refinance a student loan in the next 6 months

- Have a credit score above 640

- Sample purchased from survey vendor, Qualtrics

- 550 responses received in total

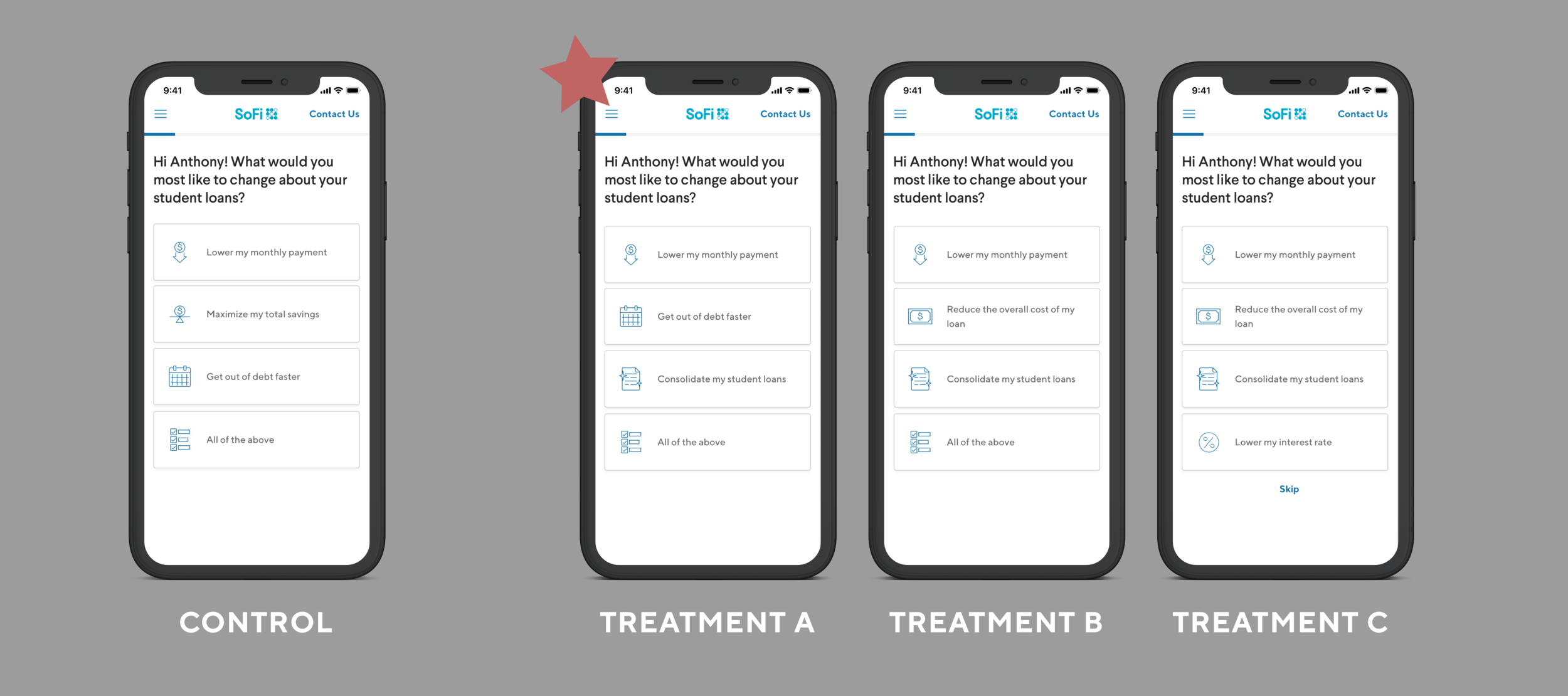

Variants

Control - No change (Treatment B from Iteration 1)

Treatment A - Remove “Maximize my total savings,” added “Consolidate my student loans”

Treatment B - Remove “Maximize my total savings,” added “Consolidate my student loans” and replaced “Get our of debt faster” with “Reduce the overall cost of my loan”

Treatment C - Remove “Maximize my total savings” and “All of the above, added “Consolidate my student loans,” Lower my interest rate” and “Skip” and replaced “Get our of debt faster” with “Reduce the overall cost of my loan”

Results

Treatment A achieved relative conversion lift of 5%.

Insights

“Consolidate my student loan” is better aligned to user goals than “Maximize total savings.” When we removed the “all of the above” option, users were more likely to select “Lower my interest rate” which was also listed as the bottom option. Users in search of a lower monthly payment and loan consolidation have a lower approval rate but convert stronger. Users looking for savings and faster payoff tend to be higher tier and most price sensitive.

Strategy

Zoom out on the driver of product offer selection rate. Include an option that we know drives the decision, interest rate. Add an option to select multiple goals instead of “All of the above” to determine user’s desire for specificity.

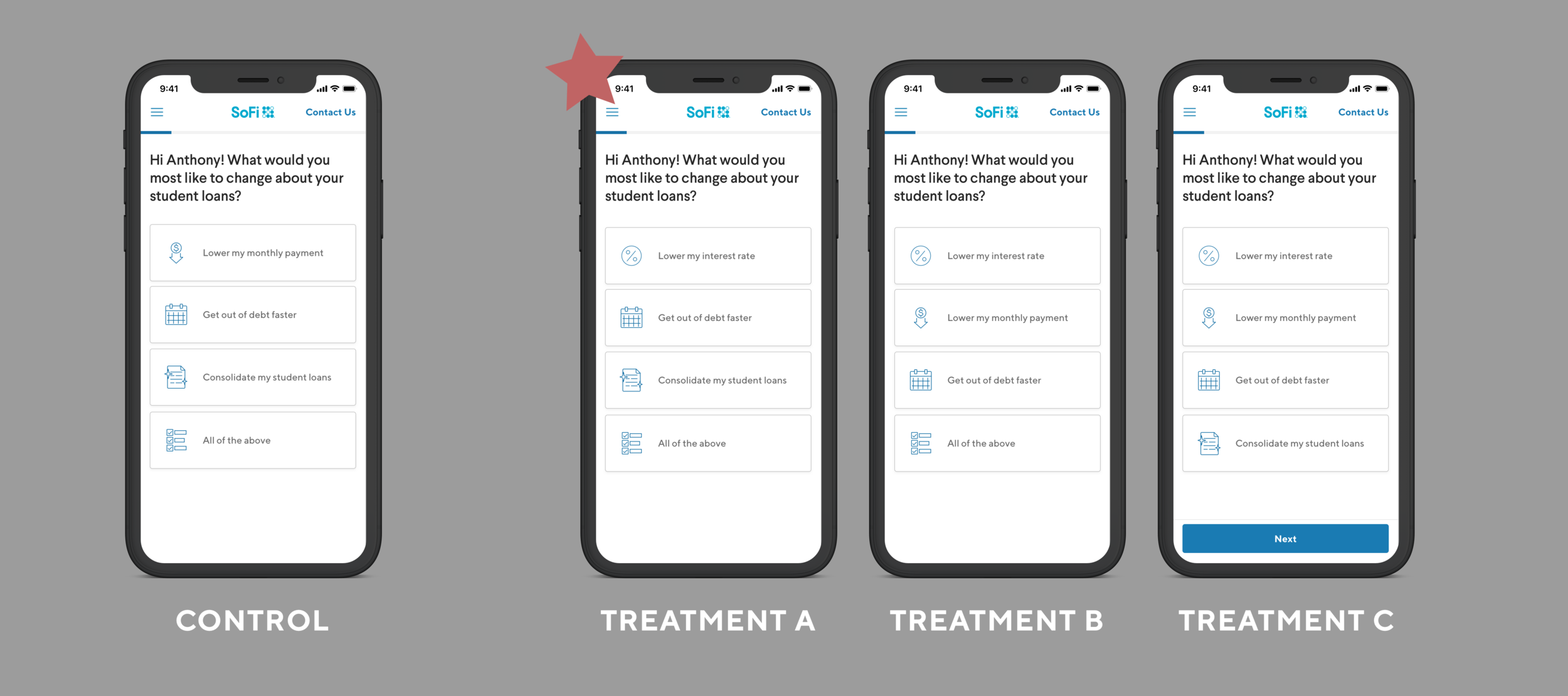

Variants

Control - No change (Treatment A in Iteration 2)

Treatment A - Replace “Lower my monthly payment” with “Lower my interest rate”

Treatment B - Replace “Consolidate my student loans” with “Lower my interest rate”

Treatment C - Remove “All of the above,” add “Lower my interest rate” and allow a multiselection.

Results

Treatment A resulted in a 3.8% relative conversion lift.

Insights

”Lower my interest rate” is the most popular option across variants. When “Consolidate my student loans” is removed, “All of the above” is favored.

What I would do differently

I would conduct user interviews or card sorting to vet the initial goals and subsequent goal iterations.

Next Steps

Incorporate this goal as a value proposition throughout the flow in copy, celebrations and as motivation in key moments (hard credit consent, application submit, etc.) Explore tailoring the flow and product offers (at right) to the goal to further customize the experience.